As it is controlled by the Federal States, the rate of Imposto sobre Circulaçao de Mercadorias e Serviços (“ICMS” or Tax on Commerce and Services) varies depending on the Federal State where the service provider is located. It also depends on the product.

SCOPE

ICMS is the main tax levied by the 26 Federal states and applies to:

- the movement of goods,

- the services of transportation between several States or municipalities,

- the telecommunications services.

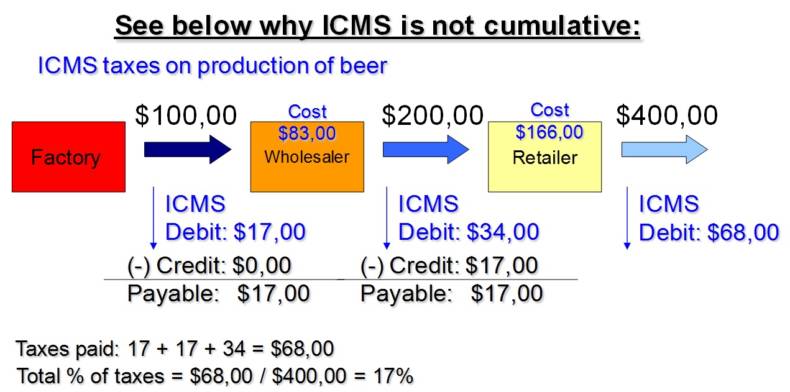

Operationally, similar to the internationally well-known Value Added Tax, the taxpayer is entitled to a tax credit of up to the amount of ICMS that was paid on expenditures incurred by the company previously.

Therefore, this tax is “not cumulative”. Thus, when purchasing goods, the ICMS is already included in the price paid to the supplier. Similarly, when the goods are resold, the sale price to be paid by the client will include the ICMS. In this way, all companies whose purchases and sales are subject to ICMS tax liabilities will pay ICMS, which corresponds to the difference between the ICMS levied on the sale, and that paid on purchases.

SUBSTITUTION ON THE RESPONSIBILITY

Substitution in the responsibility of paying taxes (“ST” or “Substitução Tributária“) is developing throughout Brazilian States. With this new process, the Tax Authorities hope to improve the amount of taxes collected and are sure to make this collection at an earlier date.

ST means that the whole amount of taxes is paid by the factory; and all intermediate companies do not get any debit or credit in ICMS! The final price paid by the consumer needs to be defined beforehand.

BASIS FOR CALCULATION

The basis of calculation for ICMS is the value of the goods sold, net of unconditional discounts, but includes related costs such as insurance and transportation.

The basis of calculation of ICMS is sometimes affected by IPI.

(art. 13 de la loi nº 87/96):

For products sold for commercial or industrial purposes, the sale price plus related costs, excluding IPI, will be the calculation basis for ICMS.

For products purchased for internal use or retained as assets in the balance sheet, the calculation basis of ICMS includes IPI.

Example:

The Company “Trade” located in São Paulo, buys – for internal consumption – goods for the price of 100,000 R$, inclusive of 15,000 R$ of IPI.

The purchase price will also include:

- Insurance 1,000 R$

- Transport 1,500 R$

Thus in this case, the ICMS will be calculated on the total price of 102,500 R$.

RATE

The rate – which varies among Federal States – is generally 17% or 18%. It also depends on the type of operation, the destination and the product.

There are also different rate depending on the origin and destination of the transaction.